Intangible Assets 101

Defining Intangible Assets:

An intangible object is something that cannot be touched, is hard to describe, or assign an exact value to. It does not have a physical nature or presence but still has value.

Intangible assets improve a small business’s long-term worth, as opposed to tangible (physical) assets, like equipment or computer hardware, that are used to calculate a business’s current worth.

Over the past 40 years, the U.S. has transitioned from a tangible asset-intensive industrial economy to an intangible asset-based service economy.

In 1975, intangible assets comprised only 17% of corporate value in the U.S.

Today intangibles account for approximately 90% of business enterprise value.

Over the last 35 years, the percentage of intangible asset value of the S&P 500 has almost tripled

“Intangible assets are the only assets that create value.”

Baruch Lev, Philip Bardes Professor of Accounting and Finance at NYU

What are Intangible Assets?

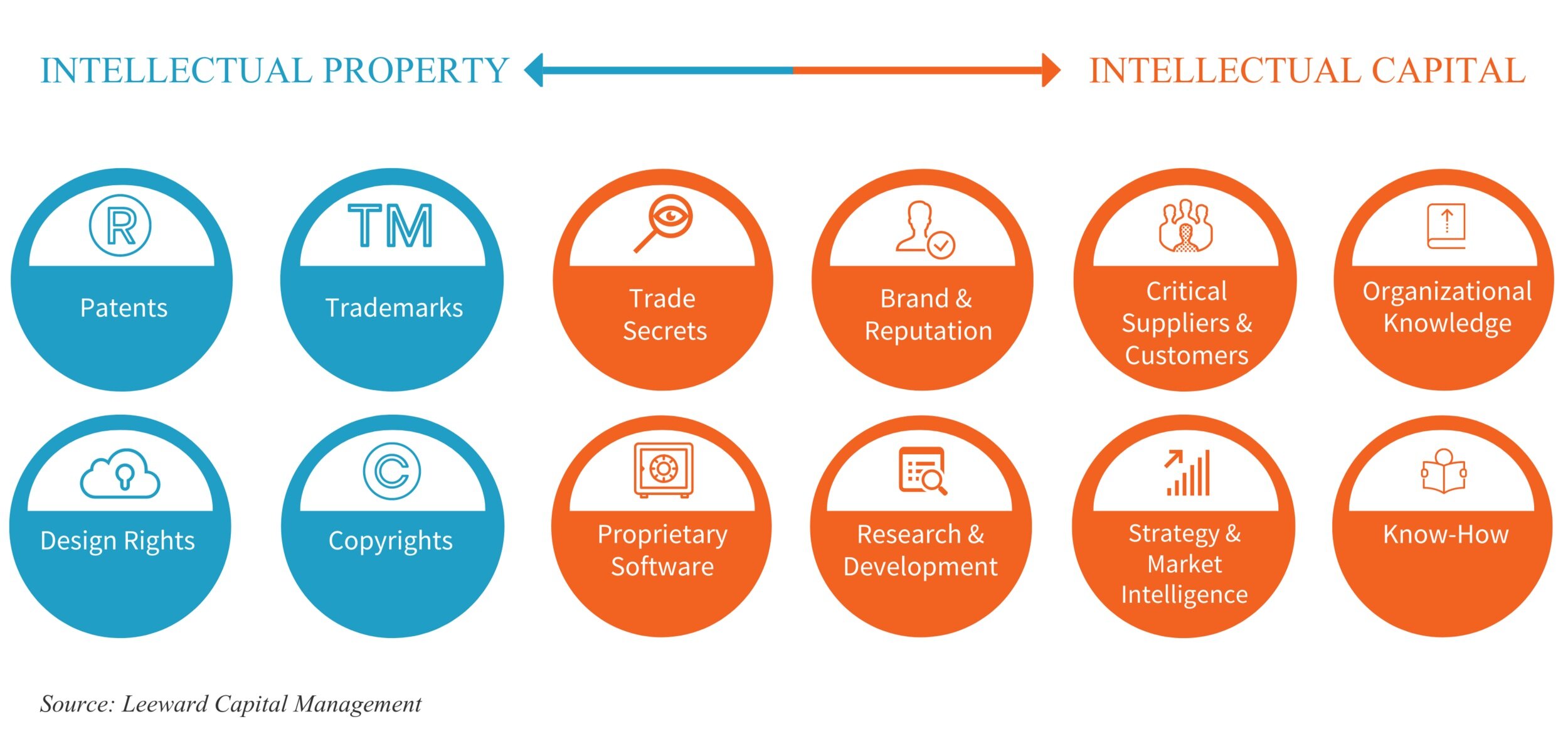

Intangible assets are everywhere within the organization. They include intellectual property assets – including patents, trademarks, copyrights and design rights – as well as “intangible capitals” such as proprietary software, trade secrets, customer lists and data, and the company’s reputation and corporate culture. But most intangibles are not found on the balance sheet and not accounted for on the company’s asset register.

Formal Intellectual Property

Formal IP is the best-understood segment of intangible asset finance because it can be sold as an asset in and of itself.

There are four specific types of formal IP and each stands alone as a unique asset class:

Patents: A patent is a legal document that declares ownership of a unique technology or process which covers how things work, what they do, how they do it and how they are made. A patent provides an owner with the ability to take legal steps to try and stop others from using the invention without permission.

Trademarks: A trademark is an image which can take the form of words, logos, pictures or some combination of these. A trademark gives the owner legal rights to stop the use of similar images which may be confusing to the trademark owner’s customers.

Design Rights: A registered design applies to the appearance of a product and gives a legal right to protect its use.

Copyrights: A copyright provides the creator of an original work the exclusive rights to its use and distribution.

Intellectual Capital (Informal IP)

While a company cannot register its intellectual capital – its informal IP - these assets can be of equal or greater importance for a company’s performance, competitive advantage and valuation. However, informal IP, which is most often seen as a catch-all in the goodwill of a company’s balance sheet, comprises a larger part of the broader market’s intangible asset value.

Trade Secrets: A trade secret is a formula, practice, process or combination of items that are generally unknown and provide a company an economic advantage over its competitors or customers.

Organizational Knowledge: Organizational knowledge is a company’s “know-how” which has been developed, documented and shared within a company. These may include training programs, systems, procedures, technical specifications or drawings.

Proprietary Software Code: Proprietary software code is owned by the firm that developed it. Source code is usually a closely guarded secret and can be valuable but it does not have the protections that registered IP receives.

Critical Partners, Suppliers, & Customers: Strong relationships are critical to most businesses and are often one of the primary reasons for a strategic acquisition.

Research & Development: R&D or innovation is the process of creating and commercializing new ideas. R&D capabilities may offer a business a short or long-term competitive advantage.

Brand: Brand is often a company’s most valuable and easily identified informal IP asset. A company’s brand may enhance a company’s reputation and differentiate it from its competitors.

Strategy & Market Intelligence: Market Intelligence is a comprehensive understanding of the industry in which a business operates.

Know-How: Know-how can be closely-held information in the form of unpatented inventions, designs, drawings, procedures, and methods. Know-how can also be the skills and experience of a firm’s employees.

There are other informal IP categories like customer and supplier relationships, organizational knowledge, and business processes that often enable or define a company’s value proposition. Understanding and articulating these informal IP assets can make a business more bankable, defensible and valuable.

Know your assets.

It’s important to know what intangible assets your company has, and it’s equally important to know:

How those assets contribute to value, revenue and sustainability

How to leverage and position those assets to maximize and extract their value

How intangibles interact with company processes, procedures and operations to create efficiencies and produce competitive advantage

Too often these intangibles are overlooked in business valuations and in company negotiations with investors, potential buyers and stakeholders. Business owners rely on old school accounting practices that don't recognize the most valuable assets of a company - their intangibles - and are left with unsatisfying business valuations.